When it comes to understanding the value of your jewelry, the terms "appraisal price" and "selling price" are sometimes confused — but each term serves a distinct purpose and is calculated differently.

Whether you're considering selling a treasured piece of jewelry or helping a customer insure a new purchase, you need to understand the difference between the two.

In this blog post, we'll settle the debate of jewelry appraisal vs. selling price by explaining their unique roles and how they impact your decision-making process.

Let’s get started.

Jewelry Appraisal vs. Selling Price

The difference between a jewelry appraisal price and a selling price revolves around intention and context. Let’s break it down.

Jewelry Appraisal Price

An appraisal price is primarily used for insurance, tax, or legal purposes. It represents the replacement value, which is the cost to replace the item with a new one of the same kind and quality.

Appraisal prices are typically higher because they consider factors like craftsmanship, materials, and market conditions at the time of appraisal. It also includes the retail markup.

This is used to determine the value for insurance coverage, estate settlements, or tax purposes.

Selling Price

The selling price is the amount for which the jewelry is actually sold to a customer at a retail store or through a private sale.

Selling prices can be lower than appraisal prices as they’re influenced by market demand, negotiation between buyer and seller, and sometimes immediate liquidation needs.

This is used in retail transactions, auctions, or private sales, reflecting the actual market conditions and buyer willingness.

While the appraisal price can provide a value for insurance or legal purposes, the selling price represents the actual transaction amount in the marketplace.

Purpose and Components of Jewelry Appraisal

You need to understand the purpose and components of a jewelry appraisal to ensure that your pieces are accurately valued and adequately protected in various legal, financial, and personal circumstances.

Purpose

- Insurance: Appraisals provide a documented value for insurance coverage, ensuring that, in the event of loss, theft, or damage, the owner can receive compensation equivalent to the item's replacement cost.

- Tax purposes: In scenarios like inheritance or donation, appraisals help determine the fair market value for tax reporting and potential deductions.

- Legal matters: For divorce settlements or estate valuations, an appraisal can serve as an authoritative document to establish the value of jewelry.

Components of Appraisal

- Replacement value: This reflects the cost to replace the item with a similar one, accounting for the current market conditions, quality of materials, and craftsmanship.

- Market conditions: The appraised value considers fluctuations in the market, like changes in the prices of precious metals and gemstones.

- Craftsmanship: The skill and effort involved in creating the piece, including design complexity and artistry, are factored into the appraisal.

- Unique characteristics: Any unique or rare aspects of the piece, like historical significance or distinctive design features, may impact the appraisal value.

Process of Appraisal

- Inspection: A thorough examination of the jewelry piece to assess its condition, authenticity, and quality.

- Documentation: Detailed descriptions and photographs are usually included in the appraisal report.

- Use of expert knowledge: The appraiser’s expertise in gemology and jewelry design plays a crucial role in determining an accurate value.

Frequency of Appraisal

- Regular updates: Jewelry values can appreciate or depreciate over time due to market trends or changes in demand. Regular appraisals ensure that insurance coverage remains adequate.

- Significant changes: Appraisals may need to be updated following significant repairs or alterations to the jewelry.

By understanding the purpose and components of a jewelry appraisal price, owners can make sure their pieces are properly valued, and legally and financially protected.

Related Read: How To Manage Jewelry Appraisals: 4 Tips for Getting Started

Setting a Selling Price

When setting a selling price for jewelry, it's important to account for various extra costs to ensure you’re making a profit. These costs can include:

- Cost of goods sold (COGS): This includes the expense for boxes, bags, and any branded materials included with the jewelry.

- Overhead costs: These are indirect costs related to running the business, like rent, utilities, insurance, and salaries for staff who are not directly involved in production.

- Marketing and advertising: These costs are associated with promoting the jewelry, including online ads, social media campaigns, and any print marketing materials.

- Packaging: This includes the expense for boxes, bags, and any branded materials included with the jewelry.

- Shipping and handling: Shipping costs can include not only the actual postage or courier charges, but also the cost of protective packaging.

- Transaction fees: These are fees charged by payment processors or credit card companies.

- Taxes and duties: These include sales tax, value-added tax (VAT), import duties, and other government-related charges that might apply.

- Warranty or return costs: These are the potential costs of honoring warranties or handling returns, including restocking and refurbishing items.

- Security: These costs are related to jewelry protection, like security systems or insurance against theft.

- Display and merchandising: Showcasing expenses are for presenting the jewelry in stores or online, including display cases and photography.

- Professional services: These are fees for legal, accounting, or consulting services that assist in the business' operations.

By considering these factors, you can set a selling price that covers all costs while maintaining a competitive edge in the market (and making more money).

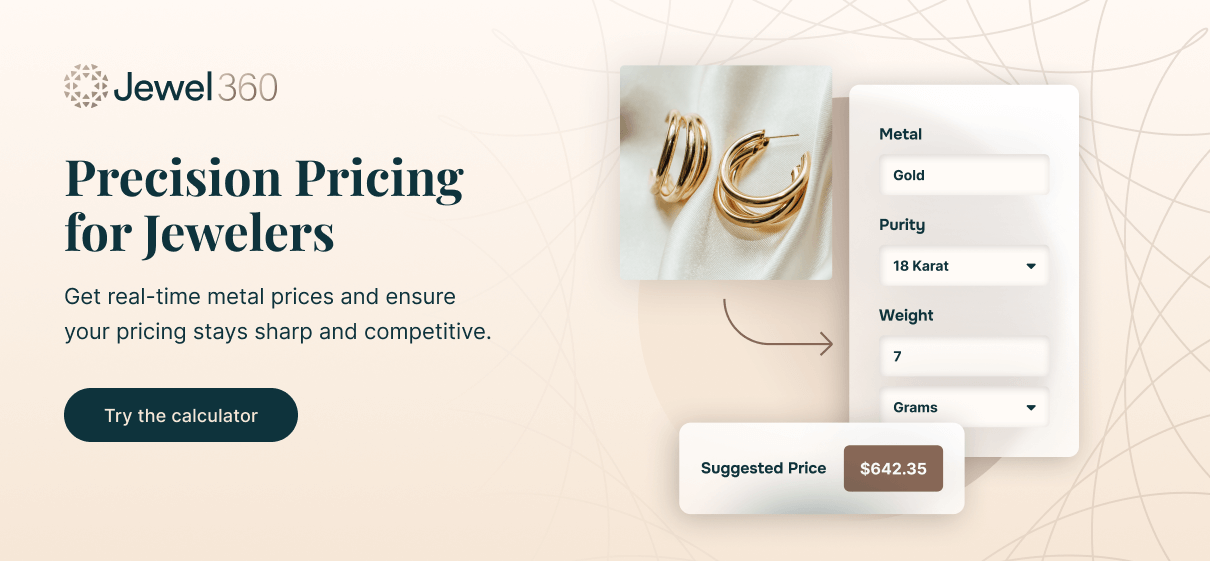

Calculate Jewelry Appraisal vs. Selling Price With Jewel360

Jewel360 is an all-in-one point of sale (POS) solution that revolutionizes the jewelry appraisal process by offering a suite of features designed to keep operations accurate and efficient. From a dedicated appraisal service to appraisal templates, Jewel360 helps you easily manage and document appraisals with consistency.

Our software's detailed item tracking and robust inventory and data management capabilities support precise cataloging and organization, which is a must for reliable appraisals.

Also, Jewel360's integration with other systems consolidates all necessary data, which improves appraisal accuracy and reliability.

Curious to see how Jewel360 can streamline your appraisal services? Schedule a demo today to experience firsthand how it can simplify your appraisal process.

.png?width=101&height=101&name=Group%201%20(1).png)

by Nick Gurney

by Nick Gurney

-Blog.webp?width=520&height=294&name=Shrinkage%20in%20Jewelry%20Retail%207%20Common%20Causes%20of%20Lost%20Inventory%20(and%20Fixes)-Blog.webp)